It pays to pay off your mortgage early

Hi KU,

Kabibili lang namin ng bahay. Ano ba ang pwede namin gawin para mabayaran namin kaagad ang utang namin sa bangko? Ayaw naman namin umabot ng 60 at nagbabayad pa rin ng utang. Masarap di ba ang mortgage-free na sa ganong idad?

Sinsirli yors,

Ano ni Mouse

Mr. Ano ni Mouse,

Madali lang ang problema mo. Holdapin mo yung bangko. Corneeh! Hindi, seriously ganito yon, let me give you a short lesson about mortgage loans. Buti na lang present ako nung itinuro ito sa class. Don’t worry, madali lang.

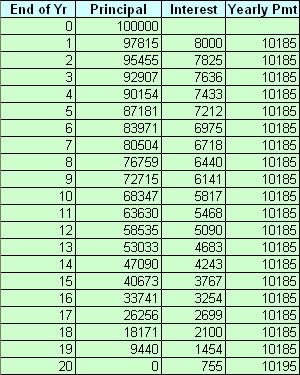

For example, you borrowed $100k from a bank at 8% annual interest for a term of 20 years. Unang tanong, how much money would you have paid at the end of 20 years?

Year 0, 100k ang utang mo. End of year 1, 8000 (8% ng principal) ang interest. Nagbayad ka ng 10185. Kaya end of year 1, 97815 (= 100000 + 8000 – 10185) na lang utang mo. So on and so forth until end of 20 years, wala ka ng utang.

If you continue paying $10185 yearly (except for the last year which is $10 more), you would have paid your loan in 20 years. If you add up all the payments, the total amount you would have paid will be (drum roll please) $203710. Which is about twice the amount of the loan! In other words kumita ang bangko ng $103k from you.

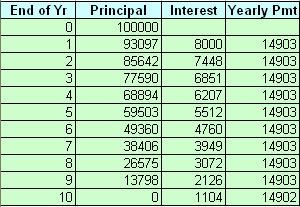

Going back to your question, ano ang pwede mong gawin para mabayaran kaagad ang utang mo? The answer is to minimize the interest payments. You can do this by paying a little bit more yearly. How much? It doesn’t matter how much as long as it is more than the minimum repayment. The table below shows an example where you pay $14903 yearly or around 50% more than the minimum repayment of $10185.

Adding up all the yearly payments, the total repayments will be (drum roll again) $149029, or a savings of $54681 compared to the previous $203710. Not only did you save $54k, you also paid off your loan in only half the term, sampung taon lang. Ang maganda pa, after the 10th year, you don't have to pay $14903 anymore. It's like having extra cash na pwede mong gastusin sa ibang bagay. Yheey, bakasyon na!

Ako naman ang magtatanong sa yo ngayon Mr. Ano Ni Mouse.

- How much should your repayments be if you want to pay off the loan in only 5 years at magkano ang mase-save mo?

- If you pay 8000 yearly, how many years will it take for you to pay off your loan?

16 Comments:

ok! ang una! hehehe...

ang laki talaga ng kita ng mga bank sa loan...more than double..grabe!

pero di yon ang pinagtataka ko...kundi ito...ang tindi mo kuya! pa'no mong nagawa yong chart na yon...bilib ako sa computation mo...very clear! mas malinaw pa sa gin!

By Unknown, at 4:25 PM, August 14, 2006

Unknown, at 4:25 PM, August 14, 2006

Totoo yan, Ka Uro, pay as much as you can. Pag may extra $ ka, ilagay mo sa mortgage payment mo. Ewan ko kung me nabankrupt na na banko sa laki ng kinikita nila.

We pay bi-weekly and when we try to put in more than the minimum.

Para kay Mr. Ano ni Mouse nalang yung computation...tingnan ko na lang answers later.

TY po Ka Uro .

By Leah, at 4:34 PM, August 14, 2006

Leah, at 4:34 PM, August 14, 2006

Ask ko lang ka Uro!

Hindi ba may charge na 5% and early settlement? Every time you pay in excess ng loan amount mo ay may charge na 5%

Paki explain lang po kung mayroon niyan diyan sa NZ.

By Anonymous, at 4:56 PM, August 14, 2006

Anonymous, at 4:56 PM, August 14, 2006

idealpinkrose,

malinaw pa ba sa gin? hehehe. tagay pa. excel ang ginamit ko.

leah,

tama yon. kasi when you pay more than the minimum, nababawasan kaagad yung principal.

anonymous,

dito naman maraming banks na pwede kang magbayad ng lump sum without additional charge provided you do so after ng fixed term interest. halimbawa may 1 year fixed interest ka na contract, tapusin mo lang yung 1 year tapos magbayad ka ng lump sum bago mo i-renew. kung floating rate naman, pwede kang mag-lump sum anytime without penalties.

By Ka Uro, at 5:48 PM, August 14, 2006

Ka Uro, at 5:48 PM, August 14, 2006

K U,

Tanong lang po talaga po bang

" 97815 (= 10000 – 8000 – 10185) na lang utang mo " ang formula nyo o typo. error lang (100,000 + 8000 – 10185 = 97,815).

Thanks sa mga informative post nyo isa talaga kayong guru.

By Anonymous, at 7:51 PM, August 14, 2006

Anonymous, at 7:51 PM, August 14, 2006

e-o,

1st kung post ito. If I may add, the more frequent your payment is, the lesser the interest you have to pay. It is OK to make monthly repayments but you'll be better off if you can make FORTHNIGHTLY (every 2 weeks) repayments, instead. Tama po ba?

JunD

By Anonymous, at 11:30 PM, August 14, 2006

Anonymous, at 11:30 PM, August 14, 2006

anonymous,

thanks for the correction. galing mo, talagang tsine-check mo ang compution. tama dapat principal+ interest - payment

junD,

that's a good question. tama ka mas makaka-menos ka sa interest if you pay forthnighly BUT the difference is very minimal.

for a 100k loan and 20 yrs term, if you pay forthnightly you pay 26 times per year for $385.77 per forthnight. (you can verify this by using PMT function in Excel). so in a year you multiply $385.77 x 26 = $10030.00

if you pay monthly, the payment is 836.44. multiplied by 12 = $10037.28.

you only save $7.28 per year. in the span of 20 years you only saved $145.60.

so not much difference. what would make a big difference is if you pay extra per year. say pay for 13 month per year. or 2 extra forthnights per year. kahit nga $10 lang per payment na extra, it will have add up to a big savings in interest payment.

By Ka Uro, at 10:35 AM, August 15, 2006

Ka Uro, at 10:35 AM, August 15, 2006

hehehe holdapin ba ang bangko? gud idea! hehehe joke!

By SarubeSan, at 1:14 PM, August 15, 2006

SarubeSan, at 1:14 PM, August 15, 2006

tanong lang.. alin bangko ang madaling holdapin ? yung wala gaanong security measures ?

By Senorito<- Ako, at 3:12 PM, August 15, 2006

Senorito<- Ako, at 3:12 PM, August 15, 2006

KU ang galing mo talaga sa numbers! pag nagkaproblem ako sa mga ganyang bagay alam ko na kung saan hingi ng advice..sana lang lagi ka available..hehe.

By ev, at 8:11 PM, August 15, 2006

ev, at 8:11 PM, August 15, 2006

KU ang galing mo talaga sa numbers! pag nagkaproblem ako sa mga ganyang bagay alam ko na kung saan hingi ng advice..sana lang lagi ka available..hehe.

By ev, at 8:11 PM, August 15, 2006

ev, at 8:11 PM, August 15, 2006

Naku mahina ako sa numbers.. huhuhu

By lheeanne, at 11:27 AM, August 16, 2006

lheeanne, at 11:27 AM, August 16, 2006

oo nga- 20 years pa yung mortgage namin- ipamana ko nalang sa anak- kalahati utang kalahati kanya...that's an eye opener- must start saving to pay it all off in 5 years- but it means wala nang holiday, new car, dinner dito, doon, etc. naku- i have a headache na, ayaw ka na ngang isipan- ibenta ko nalang kaya bahay..

By Anonymous, at 11:42 AM, August 16, 2006

Anonymous, at 11:42 AM, August 16, 2006

KU,

thanks for another enlightening post! it reinforces the idea that home ownership in NZ is realistic and reachable by anyone or any family that works hard and knows where to spend their money. for couples, very attainable ito at sa lalong madaling panahon kapag double ang income!

jazzy jayt

By Anonymous, at 12:38 PM, August 16, 2006

Anonymous, at 12:38 PM, August 16, 2006

Mukhang madugo ang pagbili ng bahay dito. Pang-dampa lang ang kaya naming mortgage :(

KU, wala ka bang bank robbery 101?

By jinkee, at 1:13 PM, August 16, 2006

jinkee, at 1:13 PM, August 16, 2006

Really makes sense to accelerate your mortgage payments so you can pay off early. You can never go wrong. Another alternative would be to use your extra money in buying tax-sheltered investments for retirement. Aside from your investment which will make money, you also get a fat income tax refund from the government. Kaya lang, your investment is really for your retirement so any pre-retirement withdrawals, the tax bite is heavy. But it is a good scheme though.

By Anonymous, at 4:14 PM, August 16, 2006

Anonymous, at 4:14 PM, August 16, 2006

Post a Comment

<< Home