The Secret to Getting Rich

Noon ang akala ko masama ang umutang. Kasi naman di ba nung bata tayo iniiwasan natin yung mga kaklaseng palautang? At kapag ika’y nautangan ng isang kaibigan, malamang simula yon ng inyong pagkakagalit. Dahil dito pumasok tuloy sa isip ko na hinding hindi ako mangungutang dahil ayokong magkaroon ng kaaway at ayokong ako’y iniiwasan. Ang akala ko rin noon ang mga mayayaman walang mga utang at ang mga may utang mahihirap lamang. Salungat pala ito sa katotohanan.

Lately ko na lang na-realize nung nasa 30s na ako na kabaligtaran pala ang palakad sa capitalist world. Dito pala, hindi masama ang umutang. Impak, mas may advantage pala kung ang tao’y may utang. Katulad na lang ng bangko ko. Noong wala pa akong utang andami kong binabayarang banking charges. Ngayon may home loan na ako sa kanila, ni-waive lahat ng transaction fees dahil isa na raw akong “preferred customer”. Ngayon kabi-kabila ang pre-approved credit cards na aking natatanggap. Noon ni isa walang gustong mag approve ng credit card sa akin.

Ngayon ko natanto na ang sikreto pala para yumaman ay ang umutang. Mas malaki utang, mas lalo kang yayaman. Ang kailangan nga lang alam mo kung saan gagamitin ang perang iyong inutang at kaya mo itong i-manage. Dapat tantiyado mo na sa bawat piso na iyong ibabayad sa nagpautang sa yo, kikita ka pa rin ng higit sa piso. Kung kikita ka ng sampung sentimo sa bawat piso, sampung sentimo pa rin yong ibubulsa mo tubo ng perang hindi naman galing sa yo.

Kaya pala ang mga mayayaman lalong yumayaman. Ang isang businessman real estate developer kayang umutang ng milyon-milyon sa bangko. Gagamitin ang perang inutang para bumili ng murang lupain, patatayuan ng mga bahay, pagkatapos ibebenta ang mga ito ng mahal. Malaki kita niya. May inilabas ba siyang pera? Malamang wala.

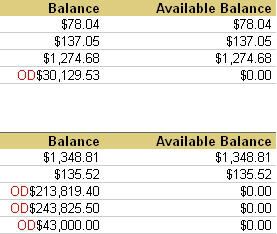

Kadalasan, mas mayaman, mas maraming utang. Yan pala ang katotohanan. Kaya nga masasabi kong isa na ako sa matatawag na mayaman, kasi malaki na utang ko. Pakita ko sa inyo ang online bank statement ko as of 22 Feb. 2006. Baka akala niyo nagbibiro ako. Yung may “OD” sa unahan, utang yon. May isa pa nga akong bangko, $250,000 naman utang ko don. Kayo na lang bahalang mag-total.

Dapat ba akong mabahala dahil sa laki ng aking utang (almost $800 thou)? Hindi naman, dahil tantiyado ko na, na in about 15 years bayad ko na lahat ito at may matatawag pa akong mga assets na ang halaga higit pa sa initial na utang ko.

So my friends, my challenge to all of you, (walang halong biro ito), is to have the courage to borrow money and put it in something that will make more money or will open the door for you to borrow more money. A good example of the latter is borrowing money to buy your own house. Because having your own house provides you the opportunity to borrow more money that you then can invest somewhere else. Don’t borrow money just to buy expensive cars, jewelries or clothes para lang may maiporma kayo. That’s just money down the drain. Use borrowed money to generate more money – that’s the secret!

20 Comments:

KU, halos pareho pala tayo ng tema ng post ngayon.

Sa iyo na lang ako uutang, pwede? hehehe

By Tanggero, at 7:37 PM, February 22, 2006

Tanggero, at 7:37 PM, February 22, 2006

Tama yan KU. Borrow money to earn more money.

By jinkee, at 8:13 PM, February 22, 2006

jinkee, at 8:13 PM, February 22, 2006

matagal ko ng prinsipyo 'yan, kaya ok ang monki-bisnis ko. hehehe

By nixda, at 8:41 PM, February 22, 2006

nixda, at 8:41 PM, February 22, 2006

pag iisipan ko :)

By Anonymous, at 10:20 PM, February 22, 2006

Anonymous, at 10:20 PM, February 22, 2006

Noong araw Ka Uro, kaming mag-asawa ay walang credit cards. Naniniwala kasi kami na kung wala kang cash na pambayad sa nais mo, eh mas mabuti pang huwag ka na lang bumili. Pero noong taong 1998, nung kami ay lumipat sa US from Germany, nagising kami sa katotohanan. Paano kasi ay nais naming umarkila ng kotse, pero ang mga dyaske eh ayaw kaming paarkilahin dahil wala daw kaming credit card. Imagine, binalewala ang aming CASH!! From then on, nagsimula kami to build our credit. Simula sa in-store credit cards, to a car loan, to a home loan, to platinum cards. Sa ganda ng credit standing, yung last car loan namin was 0% interest rate. Then nagsimula naman ako na mag-build ng credit para sa sarili ko. So far, so good. I can buy a house sa Pinas with my credit card (yan naman eh kung nais ko lang patayin ang sarili ko sa taas ng interest rate, pero ano ako bale?!!)

So the moral of my story is "your CASH is good, but i need your CREDIT"...

Have a good one!!!!

By Unknown, at 11:32 PM, February 22, 2006

Unknown, at 11:32 PM, February 22, 2006

di ako sang-ayon diyan dahil wala sa lohika. mayaman ka nga... sa utang. diyan pumapasok yung bawal kang magka-sakit dahil pag nagkataon wala kang pambayad ng mga utang. yan ang trabaho ng mga banko, to entice you with more loans kasi diyan sila kumikita. there were some cases na na-idemanda yung banko kasi pina-utang sila ng pina-utang hanggang hindi na nila mabayaran. hinahabol sila pero ang rason nila ay bakit ninyo ako pinautang. nagbayad pa yung bangko sa kanila!

By Anonymous, at 12:00 AM, February 23, 2006

Anonymous, at 12:00 AM, February 23, 2006

Wow! nicely presented! parang na-inspired akong mangutang...

PAUTANG KA URO!!!!

Dali!!! heheh

By Flex J!, at 12:16 AM, February 23, 2006

Flex J!, at 12:16 AM, February 23, 2006

There will be risks involved, for sure. But KU made a good point when he gave the example of investors borrowing large amount of money to expand their wealth through business/projects/investments. Looking at it from the viewpoint of the bank, they actually kind of "borrow" money from their clients as well by keeping their money (they make money from reinvesting). Anyway, in my opinion, when borrowing, calculate the risks and the benefits; if it's for business capital lalo na, plans should be well thought out.

Many people are on home loans, seems like a trend, everybody wanting to have their own property - which is not a bad thing. Siguraduhin lang that you are able to meet the mortgage repayments... and the shorter term the better... come to think of it, interest rates are not low. Ayayayayyy.

By Jovs, at 12:17 AM, February 23, 2006

Jovs, at 12:17 AM, February 23, 2006

tanggers,

kita mo ngang tambak na ako sa utang, uutangan mo pa ako. hahaha. after 15 years baka sakali may mapapautang na ako sa yo.

rhada,

totoo yan. ganyan din ako noon. nag-check in kami sa hotel ayaw tanggapin ang cash ko!

ngoteb,

salamat sa pag-iwan ng comment. actually noon din akala ko hindi logical. pero the fact is para maging successfull ang isang businessman, kailangan niyang mangutang. even the richest of the rich would have utang. it would be naive of you to think na si cojuangco, ayala, sy walang mga utang. that's business reality. sa business parating may risk. and to be successful you have to be prepared to take some risk. 'no guts no glory' ika nga. yung sinasabi mong bawal magkasakit totoo yon kung wala kang insurance. kaya nga may insurance in order to mitigate some of the risk. a wise businessman doesn't do business without some sort of insurance. if i invest in a commercial building i make sure the building gets insured.

banks will entice you to borrow. the same thing with credit cards. ok lang yon, but make sure you make more out of the money you borrowed. that is the secret. my loan from my bank is at 8% interest. the money i invested and after paying insurances and other expenses to lessen the risks earns, say 10%. so i have a net profit of 2% from money i never had in the first place. think about it, i don't advocate borrowing for the sake of borrowing. kailangan siempre wise ka rin.

flex j,

paguuntugin ko kayo ni tanggers eh. nakita niyo na ngang dami kong utang. ako pautangin ninyo.

jovs,

good point about risks and benefits. kailangan pagisipan mabuti. in business you can only predict as much. you can make feasibility studies and surveys to get an understanding of what kind of investments will make money. but at the end of the day, some decisions are based on gut feel and at times you would have to trust your instinct.

owning a property is the first step. once you already have a house, borrow money to buy a rental property using your own house as collateral. banks will be happy to lend you 100% of the price of the rental property. then rent out the property so that you are at least break even. the rental property pays for itself. at the end of the term of the loan you end up with another property that someone else paid for you!

ka elyong,

noon ko pa sinasabi sa iyo eh. umutang ka na then buy another property. have it rented and so it pays for itself. and as i said to jovs, at the end of the term of the loan you end up with another property that someone else paid for you! isn't that marvelous? creating assets from the bank's money, not yours?

By Ka Uro, at 9:18 AM, February 23, 2006

Ka Uro, at 9:18 AM, February 23, 2006

idadagdag ko nga pala ang isa pang bagay na hindi ko nabanggit kung bakit okay ang may utang. it's also good for tax purposes. kung may utang ka you pay less tax and/or can get a refund of taxes you paid.

let me explain.

scenario 1: halimbawa may 1 million kang sarili mong pera. then from it you start a business and made 300k in a year. all that is considered profit and will be taxable. let's say ang tax 1/3. so you pay 100k for tax.

scenario 2: you borrow 1 million from the bank at 10% (para madali computation) interest rate. the business then made 300k. because you are paying the bank 10% interest, so 100k goes to loan repayments. 200k na lang ang magiging taxable. 1/3 of 200k which is 67k ang dapat mong ibayad sa tax. you save 33k in tax payments compared sa scenario 1.

it's not illegal or unethical, but this is how big business could avoid to pay big taxes. but put it this way, it's the big businesses that generate jobs and keeps the banking industry alive.

By Ka Uro, at 9:49 AM, February 23, 2006

Ka Uro, at 9:49 AM, February 23, 2006

you are soooo right! we got pre-approved for a credit line before, but since we were too scared to go into debt, and at that time we really didn't need it, we didn't activate it!

sayang. nagsisisi tuloy kami ngayon. now, we need a credit line, kasi we wanted to payoff our mortgage in manila. naisip namin na mas mabilis namin mababayaran yun balance dahil mas maliit ang interest rate dito. tsaka instead of sending money back home, mas mabilis kung dito na lang.

ewan ko kung bakit, pero di kami ma-approve-approve ngayon. not enough credit was established daw to give us a line of credit.

samantalang wala naman kaming ka-utang-utang dito maliban sa kotse. credit cards namin always paid in full pa. 5 taon na din kami dito... not enough credit pa ba yan??? super kakapikon talaga!

By JO, at 1:05 PM, February 23, 2006

JO, at 1:05 PM, February 23, 2006

hello ka uro... dami kong natutuhan sa pagbisita sa blog nyo.. ;)

ako rin noon ayaw ko magka credit card tapos binalak kong bumili ng notebook pc, online using a debit card pero ayaw tanggapin gusto credit card?!!?

last year lang ako nagka credit card. kelangan ko rin i-establish credit history ko baka malay mo maisipan kong bumili ng bahay dito. dahil sa entry nyo napaisip tuloy ako : mangutang kaya ako sa bangko tapos mag negosyo sa pinas?! =)

By Anonymous, at 1:58 PM, February 23, 2006

Anonymous, at 1:58 PM, February 23, 2006

na-inspire ako ka uro. when we are there, we probably will have to go on business.

By Anonymous, at 4:16 PM, February 23, 2006

Anonymous, at 4:16 PM, February 23, 2006

tama ka don ka uro ! maganda rin ang may utang makakaestablished ka ng relationship at mas madali sa creditors na makita ang track records mo. good point din yan pag gusto mong magkaron ng business added capital or source of working capital . pero dapat maging matalino rin tayo sa pag uutang ,pag aaralan natin kung paano natin babayaran ito, or kaya ba natin bayaran ito. isa rin sa titignan natin ay ang interest rate involved dito .

bakekang2nz

By Anonymous, at 7:49 PM, February 23, 2006

Anonymous, at 7:49 PM, February 23, 2006

http://daveramsey.com/

ku, try to read his book "the total money makeover"...

By Anonymous, at 10:49 PM, February 23, 2006

Anonymous, at 10:49 PM, February 23, 2006

Teka gulo ng kwento ah..milyonaryo ka dun sa last na post mo tapos di pa nga kita nauutangan...may utang ka na dito sa next hehe^_^

Basta ko wala kong alam dito KU kase i hate math haha..

By Kathy, at 2:41 AM, February 24, 2006

Kathy, at 2:41 AM, February 24, 2006

Ka uro,

Kami po ay may business dito water refilling station, nag umpisa din kami sa utang, inutang namin yung makina worth Php 500,000.00 after a year nabayaran namin out of the income at syempre me iba pa gastos,so sa ngayon eto ang bread and butter namin kasi sweldo ko naman sa government mababa lang, lakasan din ng loob at tiyaga para umasenso kahit mahirap umunlad sa bansa natin dito. Ka uro March 1 po pala ang interview ko sa bangkok! God bless - Monna ( Monina Carunungan)

By Anonymous, at 4:03 AM, February 24, 2006

Anonymous, at 4:03 AM, February 24, 2006

JO,

kakapikon nga kasi ikaw na walang utang parang di ka pinagkakatiwalaan pero yung marami utang tiwala sila na pautangin pa. kakaloka.

vemsan,

ok din yung idea mo na magnegosyo sa pinas using money borrowed from abroad. jan kasi mas mura interest di tulad sa atin malaki.isa pa ang maliit na halaga, like $5000 na uutangin jan, super laki na sa atin at pwede na talagang puhunan sa business.

banjan,

good idea!

bakekang2nz,

tama yon, kailangan ng masusing pag-aaral bago pumasok sa negosyo.

daveramsey,

thanks for the suggestion. try ko hanap ng copy.

lil_kath,

hahaha. addition/subtraction lang naman ang importante dito. subtraction ung utang. ung tubo addition. eventually dapat marami addition kesa subtraction.

By Ka Uro, at 1:24 PM, February 24, 2006

Ka Uro, at 1:24 PM, February 24, 2006

walang masamang mangutang kung magbabayad at responsableng pagbabayad. 'ika nga, wag yakapin ang di mayakap. one should spend less if he earns less or one should spend more if he earns more, di ba? ang pangungutang ay ganun din. you think first if you have the capacity to pay on time. if your credit is more than your ability to pay, i think it is not responsible.

By bing, at 6:39 PM, February 25, 2006

bing, at 6:39 PM, February 25, 2006

not all animals are born equal.

someone mentioned that to me about some movie or theory. that some animals are more equal than others.

hmnn. or some animals have more rights than others like greener pastures.

during the conversation, i also pointed that i have many poor friends and equally many well off friends as well.

most of my poor friends they tell me they hate the rich, the my rich friends tells me they don't like poor people because poor people hates the rich.

i always tell my poor friends why they do hate the rich? do they have rich friends? have they gone out with rich friends? the answer always is no !!

i remember saying to my poor under previledged friends, that poor people and rich people are basically the same, we ached, we cry all the same however the difference for me when i am with them is, the rich people have the money to spend. and the laughter of the rich are more easily to catch.

i think personally i like people who loves green stuffs that makes the world go by easier.

oops maybe that's just me.

By UNCLE FOTO., at 12:29 PM, February 26, 2006

UNCLE FOTO., at 12:29 PM, February 26, 2006

Post a Comment

<< Home